Dane County’s Fall 2025 Market Insights

Dane County Market Analysis, Economy, For Buyers, For Sellers, Forecasts, Home Prices, Housing Market Updates, Infographics, Interest Rates, Inventory, Market Updates, McGrady Group Blog, Mortgage Rates, Pricing

In our Summer market outlook, we discussed the early 2025 trendlines in Price, Days on Market and interest rates matching Spring of 2024. Would this trend continue into the Summer and Fall of 2025, or would a softer real estate market begin…

Dane County’s Summer 2025 Market Insights

Dane County Market Analysis, For Buyers, For Sellers, Forecasts, Housing Market Updates, Infographics, Inventory, McGrady Group Blog, Mortgage Rates

In our Spring market outlook, we predicted that 2025 would repeat the trend lines of 2024. So far, that prediction has held steady. This update continues our focus on Dane County market data, mortgage rates, and provides insights for buyers…

Madison’s Challenge: Escalating Prices & Sluggish Listings

Dane County Market Analysis, Housing Market Updates, Interest Rates, Market Updates, McGrady Group Blog, Pricing, Time-sensitive

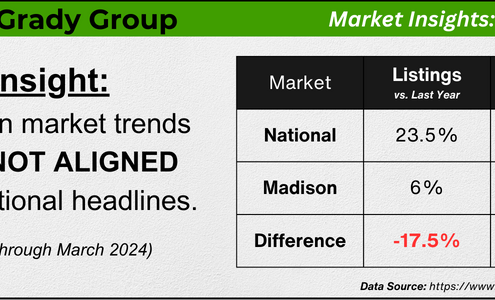

Here at The McGrady Group, we love digging into the data to determine how national headlines apply to us in South Central Wisconsin. Our latest analysis delves into how Dane County’s robust employment but lackluster listing quantity influences…

Why Owning a Home Is Worth It in the Long Run

Home Prices, Mortgage RatesToday’s mortgage rates and home prices may have you second-guessing whether it's still a good idea to buy a home right now. While market factors are definitely important, there’s also a bigger picture to consider: the long-term benefits…

When Will Mortgage Rates Come Down?

Forecasts, Mortgage RatesOne of the biggest questions on everyone’s minds right now is: when will mortgage rates come down? After several years of rising rates and a lot of bouncing around in 2024, we’re all eager for some relief.While no one can project where rates…

Control the Controllables If You’re Worried About Mortgage Rates

Mortgage RatesChances are you’re hearing a lot about mortgage rates right now, and all you really want to hear is that they’re coming back down. And if you’ve seen headlines about the early November Federal Funds Rate cut by the Federal Reserve (The…

Why Today’s Mortgage Debt Isn’t a Sign of a Housing Market Crash

Equity, Foreclosures, Mortgage RatesOne major reason why we’re not heading toward a foreclosure crisis is the high level of equity homeowners have today. Unlike in the last housing bubble, where many homeowners owed more than their homes were worth, today’s homeowners have…

What’s Behind Today’s Mortgage Rate Volatility?

Agent Value, Economy, Mortgage RatesIf you’ve been keeping an eye on mortgage rates lately, you might feel like you’re on a roller coaster ride. One day rates are up; the next they dip down a bit. So, what’s driving this constant change? Let’s dive into just a few of the…

What’s Motivating Homeowners To Move Right Now

For Sellers, Mortgage Rates, Selling TipsOver the past few years, some homeowners have decided to delay their move because they don’t want to sell and take on a higher mortgage rate on their next home. Maybe you’re thinking the same thing. And honestly, that’s no surprise. It’s…

What To Look For From This Week’s Fed Meeting

Economy, Mortgage RatesYou may be hearing a lot of talk about the Federal Reserve (the Fed) and how their actions will impact the housing market right now. Here’s why.The Fed meets again this week to decide the next step with the Federal Funds Rate. That's how much…

Q&A: How Do Presidential Elections Impact the Housing Market?

Economy, Home Prices, Infographics, Mortgage RatesSome HighlightsEven if you’re not looking to move right away, you may have questions about how the election will impact the housing market.When we look at historical trends, combined with what’s happening right now, we can find your answers.…

What To Expect from Mortgage Rates and Home Prices in 2025

Affordability, For Buyers, For Sellers, Home Prices, Mortgage RatesCurious about where the housing market is headed in 2025? The good news is that experts are offering some promising forecasts, especially when it comes to two key factors that directly affect your decisions: mortgage rates and home prices.Whether…

Why Did More People Decide To Sell Their Homes Recently?

Buying Tips, For Buyers, Mortgage RatesHomeowners typically slow down their moving plans as the summer months wrap up, and as a result, fewer homes are listed for sale in the fall. It’s a predictable, seasonal trend in real estate. But this year, mortgage rates came down at the…