Here at The McGrady Group, we love digging into the data to determine how national headlines apply to us in South Central Wisconsin. Our latest analysis delves into how Dane County’s robust employment but lackluster listing quantity influences house prices and affordability and causes it to diverge from national trends.

Unemployment: Strong in Dane County but Noisy Nationally.

Nationally, February unemployment rates were higher than last year in 247 of 389 metropolitan areas. However, Dane County registered the 4th lowest unemployment rate in the country! Low unemployment is a big part of Dane County’s economic power, but this will continue to pressure house prices and affordability.

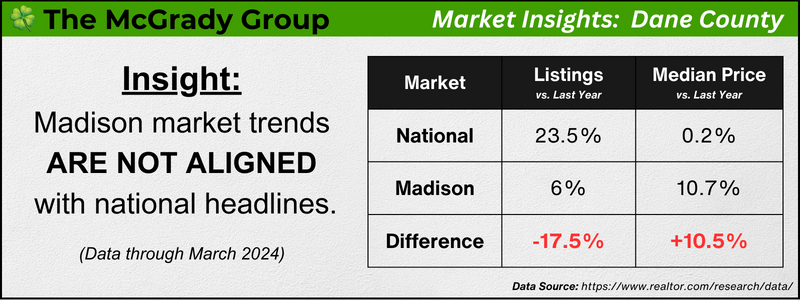

Madison is NOT Keeping Up with Listings and Price Stabilization.

You may be reading national headlines about increased listing growth over last year is helping home prices stabilize. However, Dane County’s median price increased faster than the national average in March, partly due to lower listing growth. Some experts believe we may need to hit 40% listing growth for prices to stabilize. For context on the low level of current listings view our previous post on listing quantity since 2016.

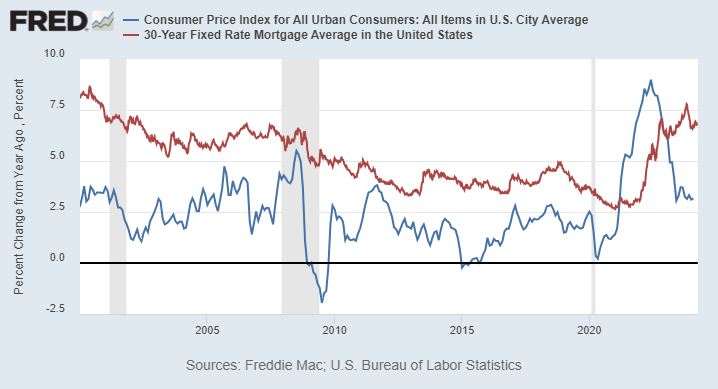

Stubborn Inflation Stymies Lower Mortgage Rates.

While inflation has stabilized compared to last year and is within historical norms, Fed policy continues to be aggressive. No interest rate relief is projected until later this year, although the outlook isn’t clear.

The chart below illustrates the significant swings in Inflation (CPI, blue line) and the 30-year fixed-rate mortgage average (red line) as compared to the last 20 years.

Learn how The McGrady Group’s proactive approach and tailored incentive programs for buyers and sellers can help you navigate these factors for a successful move this year.

Contact us now to discuss how these trends may impact your 2024 plans.

Recommended Follow

Are you a real estate data nerd? Then, we recommend a follow of Mike Simonsen from Altos Research. Subscribe to his company on YouTube or follow him on X:

Monday housing data!

— Mike Simonsen 🐉 (@mikesimonsen) April 1, 2024

Home sales are definitely increasing. I’ve highlighted the data in this thread to help everyone see what’s going on.

Inventory is climbing (+26% YoY), new listings are climbing (+18% YoY), contracts are climbing (+13% YoY). As supply grows there’s less…