Dane County’s Fall 2025 Market Insights

Dane County Market Analysis, Economy, For Buyers, For Sellers, Forecasts, Home Prices, Housing Market Updates, Infographics, Interest Rates, Inventory, Market Updates, McGrady Group Blog, Mortgage Rates, Pricing

In our Summer market outlook, we discussed the early 2025 trendlines in Price, Days on Market and interest rates matching Spring of 2024. Would this trend continue into the Summer and Fall of 2025, or would a softer real estate market begin…

Dane County’s Summer 2025 Market Insights

Dane County Market Analysis, For Buyers, For Sellers, Forecasts, Housing Market Updates, Infographics, Inventory, McGrady Group Blog, Mortgage Rates

In our Spring market outlook, we predicted that 2025 would repeat the trend lines of 2024. So far, that prediction has held steady. This update continues our focus on Dane County market data, mortgage rates, and provides insights for buyers…

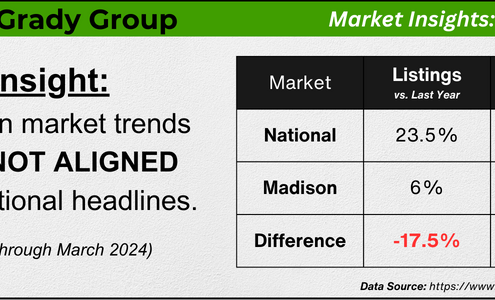

Madison’s Challenge: Escalating Prices & Sluggish Listings

Dane County Market Analysis, Housing Market Updates, Interest Rates, Market Updates, McGrady Group Blog, Pricing, Time-sensitive

Here at The McGrady Group, we love digging into the data to determine how national headlines apply to us in South Central Wisconsin. Our latest analysis delves into how Dane County’s robust employment but lackluster listing quantity influences…

Top 3 Reasons To Buy a Home Before Spring

Buying Tips, For Buyers, Home Prices, Mortgage RatesIf you’re planning to buy a home this year, you may be focused on the spring market. And hoping that when spring does hit, you’ll see:Mortgage rates drop a little more.More homes hit the market.But here’s what most buyers don’t realize.…

Mortgage Rates Recently Hit a 3-Year Low. Here’s Why That’s Still a Big Deal.

Affordability, For Buyers, Mortgage RatesIf you’re one of the thousands of homebuyers waiting for rates to fall, you should know it’s already happening. And they recently crossed an important milestone. Rates officially dipped their toes into the 5s – something that hasn’t…

Expert Forecasts Point to Affordability Improving in 2026

For Buyers, For Sellers, Forecasts, Home Prices, Inventory, Mortgage RatesWondering what to expect from the housing market in 2026? You’re not the only one. For the past few years, affordability has been the biggest barrier standing between most people and their next move. And a lot of buyers and sellers have been…

Why More Homeowners Are Giving Up Their Low Mortgage Rate

For Sellers, Mortgage Rates, Selling TipsIf you’re like a lot of homeowners, you’ve probably thought: “I’d like to move… but I don’t want to give up my 3% rate.” That’s fair. That rate has been one of your best financial wins – and it can be hard to let go. But here’s…

The Housing Market Is Turning a Corner Going into 2026

For Buyers, For Sellers, Forecasts, Inventory, Mortgage RatesAfter several years of high mortgage rates and hesitation from buyers, momentum is quietly building beneath the surface of the housing market. Sellers are reappearing. Buyers are re-engaging. And for the first time in what feels like forever,…

Would You Let $80 a Month Hold You Back from Buying a Home?

Affordability, First-Time Buyers, For Buyers, Forecasts, Mortgage RatesA lot of buyers are stuck in “wait and see” mode right now. They’re watching rates hover a little above 6% and thinking, I’ll buy once they hit the 5s. Because who doesn’t want a better rate?But here’s the thing: that 5.99% number…

Why You Don’t Need To Be Afraid of Today’s Mortgage Rates

Buying Tips, Downsize, First-Time Buyers, For Buyers, For Sellers, Mortgage Rates, Move-UpMortgage rates have been the monster under the bed for a while. Every time they tick up, people flinch and say, “Maybe I’ll wait.” But here’s the twist. Waiting for that perfect 5-point-something rate could end up haunting your wallet…

The $280 Shift in Affordability Every Homebuyer Should Know

Affordability, Buying Tips, First-Time Buyers, For Sellers, Mortgage Rates, Move-UpIf you paused your plans to move because of high rates or prices, it may finally be time to take a second look at your numbers. Affordability is improving in 39 of the top 50 markets, according to First American. And that’s the 5th straight…

2026 Housing Market Outlook

For Buyers, For Sellers, Forecasts, Home Prices, Mortgage RatesAfter a couple of years where the housing market felt stuck in neutral, 2026 may be the year things shift back into gear. Expert forecasts show more people are expected to move – and that could open the door for you to do the same.More Homes…