Dane County’s Fall 2025 Market Insights

Dane County Market Analysis, Economy, For Buyers, For Sellers, Forecasts, Home Prices, Housing Market Updates, Infographics, Interest Rates, Inventory, Market Updates, McGrady Group Blog, Mortgage Rates, Pricing

In our Summer market outlook, we discussed the early 2025 trendlines in Price, Days on Market and interest rates matching Spring of 2024. Would this trend continue into the Summer and Fall of 2025, or would a softer real estate market begin…

Dane County’s Summer 2025 Market Insights

Dane County Market Analysis, For Buyers, For Sellers, Forecasts, Housing Market Updates, Infographics, Inventory, McGrady Group Blog, Mortgage Rates

In our Spring market outlook, we predicted that 2025 would repeat the trend lines of 2024. So far, that prediction has held steady. This update continues our focus on Dane County market data, mortgage rates, and provides insights for buyers…

Madison’s Challenge: Escalating Prices & Sluggish Listings

Dane County Market Analysis, Housing Market Updates, Interest Rates, Market Updates, McGrady Group Blog, Pricing, Time-sensitive

Here at The McGrady Group, we love digging into the data to determine how national headlines apply to us in South Central Wisconsin. Our latest analysis delves into how Dane County’s robust employment but lackluster listing quantity influences…

Why an Agent Is Essential When Buying a Newly Built Home

Agent Value, Buying Tips, For BuyersFor some buyers, there’s a misconception that newly built homes aren’t made to last or fall short of the quality you can find in older homes. Unfortunately, this is turning some buyers away from what may be one of their best options in today’s…

Why a Condo Could Be Your Perfect First Home

For BuyersIf you’re looking to break into homeownership but the price of single-family homes has you second-guessing, you might want to consider a condominium (condo) or townhome. These types of homes often come with a lower barrier to entry – and…

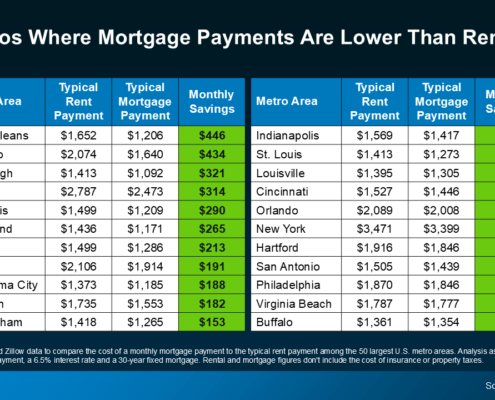

Buying Beats Renting in These Top Cities

For Buyers, Infographics, Rent vs. BuySome HighlightsBased on a recent study, in 22 of the top 50 metros, the monthly mortgage payment is lower than the rent payment.Make sure you work with a pro who can help you crunch the numbers and see how your city stacks up. This may be your…

Home Values Rise Even as Median Prices Fall

For Buyers, For Sellers, Home PricesRecent headlines have been buzzing about the median asking price of homes dropping compared to last year, and that’s sparked plenty of confusion. And as a buyer or seller, it’s easy to assume that means prices are coming down. But here’s…

This Is the Sweet Spot Homebuyers Have Been Waiting For

For Buyers, Mortgage RatesAfter months of sitting on the sidelines, many homebuyers who were priced out by high mortgage rates and affordability challenges finally have an opportunity to make their move. With rates trending down, today’s market is a sweet spot for…

Buying Beats Renting in 22 Major U.S. Cities

Affordability, For Buyers, Home Prices, Inventory, Mortgage RatesThat’s right—according to a recent study from Zillow, in 22 of the 50 largest metro areas, monthly mortgage payments are now lower than rent payments (see chart below):As mortgage rates have eased off their recent peak, home prices have…

Buy Now, or Wait?

Buying Tips, For Buyers, Infographics, Mortgage RatesSome HighlightsIf you’re wondering if you should buy now or wait, here’s what you need to know. If you wait for rates to drop more, you’ll have to deal with more competition and higher prices as additional buyers jump back in. But if you…

Don’t Fall for These Real Estate Agent Myths

Agent Value, Buying Tips, For Buyers, For Sellers, Selling TipsWhen it’s time to buy or sell a home, one of the most important decisions you’ll make is who you’ll work with as your agent. That choice will have an impact on your entire experience and how smoothly it goes.As you figure out who you’ll…

Why Buying Now May Be Worth It in the Long Run

Buying Tips, Equity, First-Time Buyers, For Buyers, Home PricesShould you buy a home now or should you wait? That’s a question a lot of people have these days. And while what’s right for you is going to depend on a lot of different factors, here’s something you’ll want to consider as you make your…

The Down Payment Assistance You Didn’t Know About

First-Time Buyers, For BuyersBelieve it or not, almost 80% of first-time homebuyers qualify for down payment assistance, but only 13% actually use it. And if you’re hoping to buy a home, this is a mission-critical gap to close – fast (see graph below):Here’s what…