Dane County’s Fall 2025 Market Insights

Dane County Market Analysis, Economy, For Buyers, For Sellers, Forecasts, Home Prices, Housing Market Updates, Infographics, Interest Rates, Inventory, Market Updates, McGrady Group Blog, Mortgage Rates, Pricing

In our Summer market outlook, we discussed the early 2025 trendlines in Price, Days on Market and interest rates matching Spring of 2024. Would this trend continue into the Summer and Fall of 2025, or would a softer real estate market begin…

Dane County’s Summer 2025 Market Insights

Dane County Market Analysis, For Buyers, For Sellers, Forecasts, Housing Market Updates, Infographics, Inventory, McGrady Group Blog, Mortgage Rates

In our Spring market outlook, we predicted that 2025 would repeat the trend lines of 2024. So far, that prediction has held steady. This update continues our focus on Dane County market data, mortgage rates, and provides insights for buyers…

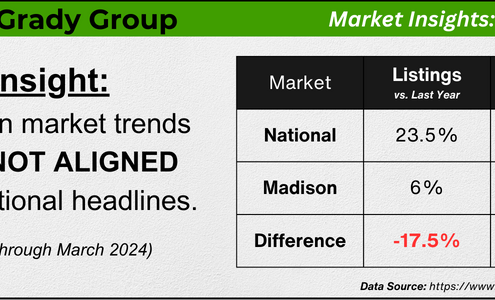

Madison’s Challenge: Escalating Prices & Sluggish Listings

Dane County Market Analysis, Housing Market Updates, Interest Rates, Market Updates, McGrady Group Blog, Pricing, Time-sensitive

Here at The McGrady Group, we love digging into the data to determine how national headlines apply to us in South Central Wisconsin. Our latest analysis delves into how Dane County’s robust employment but lackluster listing quantity influences…

2025 Housing Market Forecasts: What To Expect

For Buyers, For Sellers, Forecasts, Home Prices, Mortgage RatesLooking ahead to 2025, it's important to know what experts are projecting for the housing market. And whether you're thinking of buying or selling a home next year, having a clear picture of what they’re calling for can help you make the best…

What’s the Impact of Presidential Elections on the Housing Market?

Economy, For Buyers, For Sellers, Home Prices, Inventory, Mortgage RatesIt’s no surprise that the upcoming Presidential election might have you speculating about what’s ahead. And those unanswered thoughts can quickly spiral, causing fear and uncertainty to swirl through your mind. So, if you’ve been considering…

How Growing Inventory Benefits Today’s Buyers

For Buyers, Infographics, InventorySome HighlightsWhile the number of homes for sale varies by local area, nationally we’re up over 36% year-over-year, but still down almost 29% compared to what’s normal.Here’s what that means when you buy: more options for your search,…

Today’s Biggest Housing Market Myths

Buying Tips, Economy, For Buyers, Mortgage RatesHave you ever heard the phrase: don’t believe everything you hear? That’s especially true if you’re thinking about buying or selling a home in today’s housing market. There’s a lot of misinformation out there. And right now, making…

How To Choose a Great Local Real Estate Agent

Agent Value, For Buyers, For SellersSelecting the right real estate agent can make a world of difference when buying or selling a home. But how do you find the best one? Here are some tips to help you make that big decision as you determine your partner in the process.Check Their…

How Mortgage Rate Changes Impact Your Homebuying Power

For Buyers, For Sellers, Mortgage RatesIf you’re thinking about buying or selling a home, you’ve probably got mortgage rates on your mind. That’s because you’ve likely heard that mortgage rates impact how much you can afford in your monthly mortgage payment, and you want…

3 Reasons To Move in Today’s Shifting Market

For Buyers, Infographics, Mortgage RatesSome HighlightsThe housing market is in a transition. And that gives you 3 key opportunities going into the fall.There are more homes actively for sale. Builders are motivated to sell, so a newly built home may be more achievable than you think.…

What Credit Score Do You Really Need To Buy a House?

Agent Value, Buying Tips, First-Time Buyers, For BuyersWhen you're thinking about buying a home, your credit score is one of the biggest pieces of the puzzle. Think of it like your financial report card that lenders look at when trying to figure out if you qualify, and which home loan will work…

Is Affordability Starting To Improve?

Affordability, Economy, For Buyers, Home Prices, Mortgage RatesOver the past couple of years, a lot of people have had a hard time buying a home. And while affordability is still tight, there are signs it's getting a little better and might keep improving throughout the rest of the year. Lawrence Yun, Chief…

Are There More Homes for Sale Where You Live?

For Buyers, InventoryOne of the biggest bright spots in today’s housing market is how much the supply of homes for sale has grown since the beginning of this year. Recent data from Realtor.com shows that nationally, there are 36.6% more homes actively for sale…