Dane County’s Fall 2025 Market Insights

Dane County Market Analysis, Economy, For Buyers, For Sellers, Forecasts, Home Prices, Housing Market Updates, Infographics, Interest Rates, Inventory, Market Updates, McGrady Group Blog, Mortgage Rates, Pricing

In our Summer market outlook, we discussed the early 2025 trendlines in Price, Days on Market and interest rates matching Spring of 2024. Would this trend continue into the Summer and Fall of 2025, or would a softer real estate market begin…

Dane County’s Summer 2025 Market Insights

Dane County Market Analysis, For Buyers, For Sellers, Forecasts, Housing Market Updates, Infographics, Inventory, McGrady Group Blog, Mortgage Rates

In our Spring market outlook, we predicted that 2025 would repeat the trend lines of 2024. So far, that prediction has held steady. This update continues our focus on Dane County market data, mortgage rates, and provides insights for buyers…

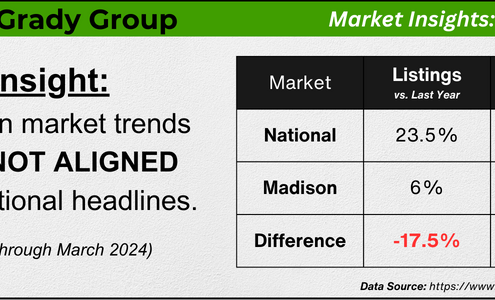

Madison’s Challenge: Escalating Prices & Sluggish Listings

Dane County Market Analysis, Housing Market Updates, Interest Rates, Market Updates, McGrady Group Blog, Pricing, Time-sensitive

Here at The McGrady Group, we love digging into the data to determine how national headlines apply to us in South Central Wisconsin. Our latest analysis delves into how Dane County’s robust employment but lackluster listing quantity influences…

Your Needs Matter More Than Today’s Mortgage Rates

For Buyers, For Sellers, Interest Rates, Move-Up BuyersIf you’re thinking about selling your house right now, chances are it’s because something in your life has changed. And, while things like mortgage rates are a key part of your decision on what you’ll buy next, it’s important to not…

The Main Reason Mortgage Rates Are So High

For Buyers, Interest RatesToday’s mortgage rates are top-of-mind for many homebuyers right now. As a result, if you’re thinking about buying for the first time or selling your current house to move into a home that better fits your needs, you may be asking yourself…

The Impact of Changing Mortgage Rates [INFOGRAPHIC]

For Buyers, Infographics, Interest RatesSome HighlightsIf you’re looking to buy a home, you should know even a small change in mortgage rates has an impact on your purchasing power.These charts show how rates generally affect your monthly payment.The best way to navigate changing…

The Impact of Inflation on Mortgage Rates

Housing Market Updates, Interest RatesIf you’re reading headlines about inflation or mortgage rates, you may see something about the recent decision from the Federal Reserve (the Fed). But what does it mean for you, the housing market, and your plans to buy a home? Here’s what…

A Recession Doesn’t Equal a Housing Crisis

Housing Market Updates, Interest Rates, PricingEverywhere you look, people are talking about a potential recession. And if you’re planning to buy or sell a house, this may leave you wondering if your plans are still a wise move. To help ease your mind, experts are saying that if we do…

Ways To Overcome Affordability Challenges in Today’s Housing Market [INFOGRAPHIC]

First Time Home Buyers, For Buyers, Infographics, Interest Rates, Move-Up Buyers, PricingSome HighlightsWith so few homes on the market right now, widening the scope of your search to include nearby areas could help you find more options in your budget.You can also work with a trusted lender to consider alternative financing options…

The Three Factors Affecting Home Affordability Today

First Time Home Buyers, For Buyers, Housing Market Updates, Interest Rates, Move-Up Buyers, PricingThere’s been a lot of focus on higher mortgage rates and how they’re creating affordability challenges for today’s homebuyers. It’s true that rates climbed dramatically since the record-low we saw during the pandemic. But home affordability…

What Are the Experts Saying About the Spring Housing Market?

For Buyers, For Sellers, Housing Market Updates, Interest Rates, PricingThe housing market’s been going through a lot of change lately, and there’s been uncertainty surrounding what will happen this spring. You may be wondering if more homes will go on the market, what’s next with home prices and mortgage…

How Changing Mortgage Rates Can Affect You

Buying Myths, For Buyers, Interest RatesThe 30-year fixed mortgage rate has been bouncing between 6% and 7% this year. If you’ve been on the fence about whether to buy a home or not, it’s helpful to know exactly how a 1%, or even a 0.5%, mortgage rate shift affects your purchasing…

What You Should Know About Rising Mortgage Rates

First Time Home Buyers, For Buyers, Housing Market Updates, Interest Rates, Move-Up BuyersAfter steadily falling over the winter, mortgage rates have started to rise in recent weeks. This is concerning to some potential homebuyers as the combination of higher mortgage rates and higher prices have made homes less affordable. So, if…