Dane County’s Fall 2025 Market Insights

Dane County Market Analysis, Economy, For Buyers, For Sellers, Forecasts, Home Prices, Housing Market Updates, Infographics, Interest Rates, Inventory, Market Updates, McGrady Group Blog, Mortgage Rates, Pricing

In our Summer market outlook, we discussed the early 2025 trendlines in Price, Days on Market and interest rates matching Spring of 2024. Would this trend continue into the Summer and Fall of 2025, or would a softer real estate market begin…

Dane County’s Summer 2025 Market Insights

Dane County Market Analysis, For Buyers, For Sellers, Forecasts, Housing Market Updates, Infographics, Inventory, McGrady Group Blog, Mortgage Rates

In our Spring market outlook, we predicted that 2025 would repeat the trend lines of 2024. So far, that prediction has held steady. This update continues our focus on Dane County market data, mortgage rates, and provides insights for buyers…

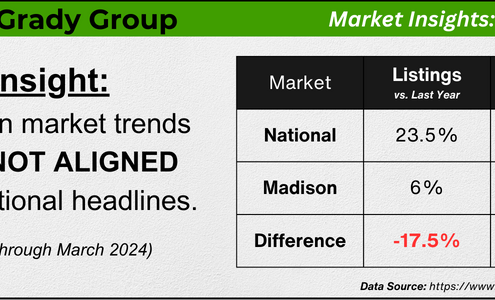

Madison’s Challenge: Escalating Prices & Sluggish Listings

Dane County Market Analysis, Housing Market Updates, Interest Rates, Market Updates, McGrady Group Blog, Pricing, Time-sensitive

Here at The McGrady Group, we love digging into the data to determine how national headlines apply to us in South Central Wisconsin. Our latest analysis delves into how Dane County’s robust employment but lackluster listing quantity influences…

Why You Shouldn’t Fear Today’s Foreclosure Headlines

For Buyers, For Sellers, Foreclosures, Housing Market UpdatesIf you’ve seen recent headlines about foreclosures surging in the housing market, you’re certainly not alone. There’s no doubt, the stories in the media can be pretty confusing right now. They may even make you think twice about buying…

The 3 Factors That Affect Home Affordability

First Time Home Buyers, For Buyers, Housing Market Updates, Interest Rates, Move-Up Buyers, PricingIf you’ve been following the housing market over the last couple of years, you’ve likely heard about growing affordability challenges. But according to experts, the key factors that determine housing affordability are projected to improve…

Have Home Values Hit Bottom?

For Buyers, For Sellers, PricingWhether you’re already a homeowner or you’re looking to become one, the recent headlines about home prices may leave you with more questions than answers. News stories are talking about home prices falling, and that’s raising concerns…

Think Twice Before Waiting for 3% Mortgage Rates

Buying Myths, First Time Home Buyers, For Buyers, Interest Rates, Move-Up BuyersLast year, the Federal Reserve took action to try to bring down inflation. In response to those efforts, mortgage rates jumped up rapidly from the record lows we saw in 2021, peaking at just over 7% last October. Hopeful buyers experienced a…

What Past Recessions Tell Us About the Housing Market

For Buyers, For Sellers, Housing Market UpdatesIt doesn’t matter if you’re someone who closely follows the economy or not, chances are you’ve heard whispers of an upcoming recession. Economic conditions are determined by a broad range of factors, so rather than explaining them each…

Key Terms To Know When Buying a Home [INFOGRAPHIC]

Buying Myths, Down Payments, First Time Home Buyers, For Buyers, Infographics, Move-Up BuyersSome Highlights Buying a home is a major transaction that can seem even more complex when you don’t understand the terms used throughout the process. If you’re looking to become a homeowner this year, it’s important to know these housing…

Today’s Housing Market Is Nothing Like 15 Years Ago

For Buyers, For Sellers, Foreclosures, Housing Market UpdatesThere’s no doubt today’s housing market is very different than the frenzied one from the past couple of years. In the second half of 2022, there was a dramatic shift in real estate, and it caused many people to make comparisons to the 2008…

What Are Your Goals in the Housing Market This Year?

First Time Home Buyers, For Buyers, Interest Rates, Move-Up Buyers

If buying or selling a home is part of your dreams for 2023, it’s essential for you to understand today’s housing market, define your goals, and work with industry experts to bring your homeownership vision for the new year into focus.

In…

Applying For a Mortgage? Here’s What You Should Avoid Once You Do.

Buying Myths, First Time Home Buyers, For Buyers

While it’s exciting to start thinking about moving in and decorating after you’ve applied for your mortgage, there are some key things to keep in mind before you close. Here’s a list of things you may not realize you need to avoid after…

Confused About What’s Going on in the Housing Market? Lean on a Professional.

Buying Myths, For Buyers, For Sellers, Selling Myths

If you’re thinking about buying or selling a home, you probably want to know what’s really happening with home prices, mortgage rates, housing supply, and more. That’s not an easy task considering how sensationalized headlines are today.…