Dane County’s Fall 2025 Market Insights

Dane County Market Analysis, Economy, For Buyers, For Sellers, Forecasts, Home Prices, Housing Market Updates, Infographics, Interest Rates, Inventory, Market Updates, McGrady Group Blog, Mortgage Rates, Pricing

In our Summer market outlook, we discussed the early 2025 trendlines in Price, Days on Market and interest rates matching Spring of 2024. Would this trend continue into the Summer and Fall of 2025, or would a softer real estate market begin…

Dane County’s Summer 2025 Market Insights

Dane County Market Analysis, For Buyers, For Sellers, Forecasts, Housing Market Updates, Infographics, Inventory, McGrady Group Blog, Mortgage Rates

In our Spring market outlook, we predicted that 2025 would repeat the trend lines of 2024. So far, that prediction has held steady. This update continues our focus on Dane County market data, mortgage rates, and provides insights for buyers…

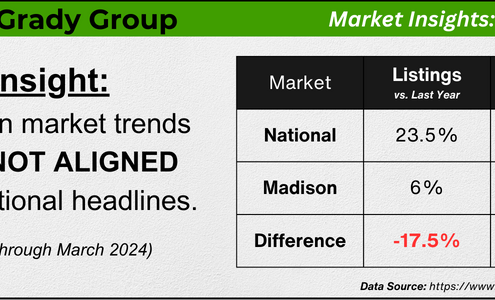

Madison’s Challenge: Escalating Prices & Sluggish Listings

Dane County Market Analysis, Housing Market Updates, Interest Rates, Market Updates, McGrady Group Blog, Pricing, Time-sensitive

Here at The McGrady Group, we love digging into the data to determine how national headlines apply to us in South Central Wisconsin. Our latest analysis delves into how Dane County’s robust employment but lackluster listing quantity influences…

Why You Need a True Expert in Today’s Housing Market

Buying Myths, First Time Home Buyers, For Buyers, For Sellers, Selling MythsThe housing market continues to shift and change, and in a fast-moving landscape like we’re in right now, it’s more important than ever to have a trusted real estate agent on your side. Whether you’re buying your first home or selling…

Why You Don’t Need To Fear the Return of Adjustable-Rate Mortgages

Buying Myths, For Buyers, Interest RatesIf you remember the housing crash back in 2008, you may recall just how popular adjustable-rate mortgages (ARMs) were back then. And after years of being virtually nonexistent, more people are once again using ARMs when buying a home. Let’s…

Why Median Home Sales Price Is Confusing Right Now

Buying Myths, For Buyers, For Sellers, Housing Market Updates, Pricing, Selling MythsThe National Association of Realtors (NAR) is set to release its most recent Existing Home Sales (EHS) report tomorrow. This monthly release provides information on the volume of sales and price trends for homes that have previously been owned.…

People Want Less Expensive Homes – And Builders Are Responding

For Buyers, Housing Market Updates, Interest Rates, PricingIn today’s housing market, there are two main affordability challenges impacting buyers: mortgage rates that are higher than they’ve been the past couple of years, and rising home prices caused by low inventory. To overcome those challenges,…

Don’t Expect a Flood of Foreclosures

Buying Myths, For Buyers, For Sellers, Foreclosures, Housing Market Updates, Selling MythsThe rising cost of just about everything from groceries to gas right now is leading to speculation that more people won’t be able to afford their mortgage payments. And that’s creating concern that a lot of foreclosures are on the horizon.…

Where Are People Moving Today and Why?

Buying Myths, First Time Home Buyers, For BuyersPlenty of people are still moving these days. And if you’re thinking of making a move yourself, you may be considering the inventory and affordability challenges in the housing market and wondering what you can do to help offset those. A new…

Home Prices Are Back on the Rise [INFOGRAPHIC]

For Buyers, For Sellers, Housing Market Updates, Infographics, PricingSome HighlightsLooking at monthly home price data from six expert sources shows the worst home price declines are behind us, and they’re rising again nationally.If you’ve put your plans to move on pause because you were worried about home…

The Value of an Agent When Buying Your New Construction Home

Buying Myths, First Time Home Buyers, For BuyersBuying a new construction home can be an exciting experience. From being the very first owner, to customizing your home’s features, there are a lot of benefits. But navigating the complexities of buying a home that’s under construction can…

Four Ways You Can Use Your Home Equity

Buying Myths, First Time Home Buyers, For Buyers, Foreclosures, Move-Up BuyersIf you’re a homeowner, odds are your equity has grown significantly over the last few years. Equity builds over time as home values grow and as you pay down your home loan. And, since home prices skyrocketed during the ‘unicorn’ years,…

Housing Market Forecast for the Rest of 2023 [INFOGRAPHIC]

For Buyers, For Sellers, Housing Market Updates, Infographics, Interest Rates, PricingSome HighlightsWant to know what experts say will happen in the rest of 2023? Home prices are already appreciating again in many areas. The average of the expert forecasts shows positive price growth.Where mortgage rates go for the rest of the…