Dane County’s Fall 2025 Market Insights

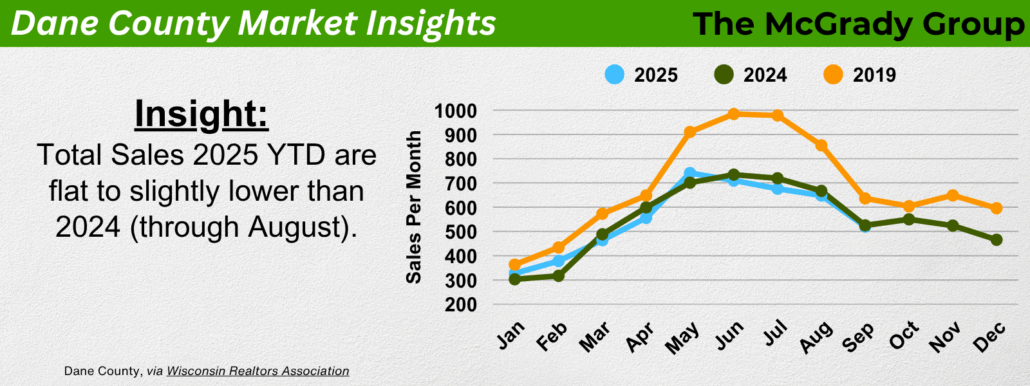

In our Summer market outlook, we discussed the early 2025 trendlines in Price, Days on Market and interest rates matching Spring of 2024. Would this trend continue into the Summer and Fall of 2025, or would a softer real estate market begin to take over? Analyzing our Q2 and Q3 data, some new trends are popping up.

Sellers Market Headwinds

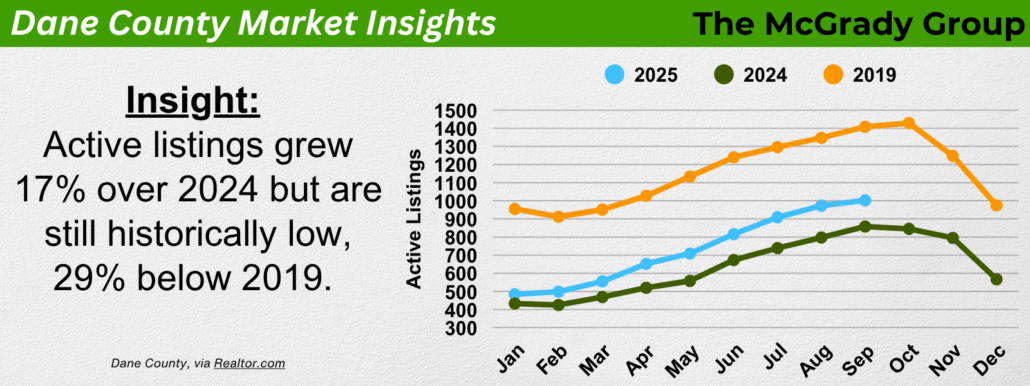

Dane County sellers have been in control for a long, long time. One of the main reasons for this is our historical drop in active listings, which creates a simple supply and demand dilemma. As you can see below, new and active listings have made a big jump, up 17% compared to Q2/Q3 2024. For context, we added the 2019 “pre-pandemic” active listings to reinforce the fact that we are still well below a “normal market”. The recent uptick is a new trend and is welcome news for our buyers.

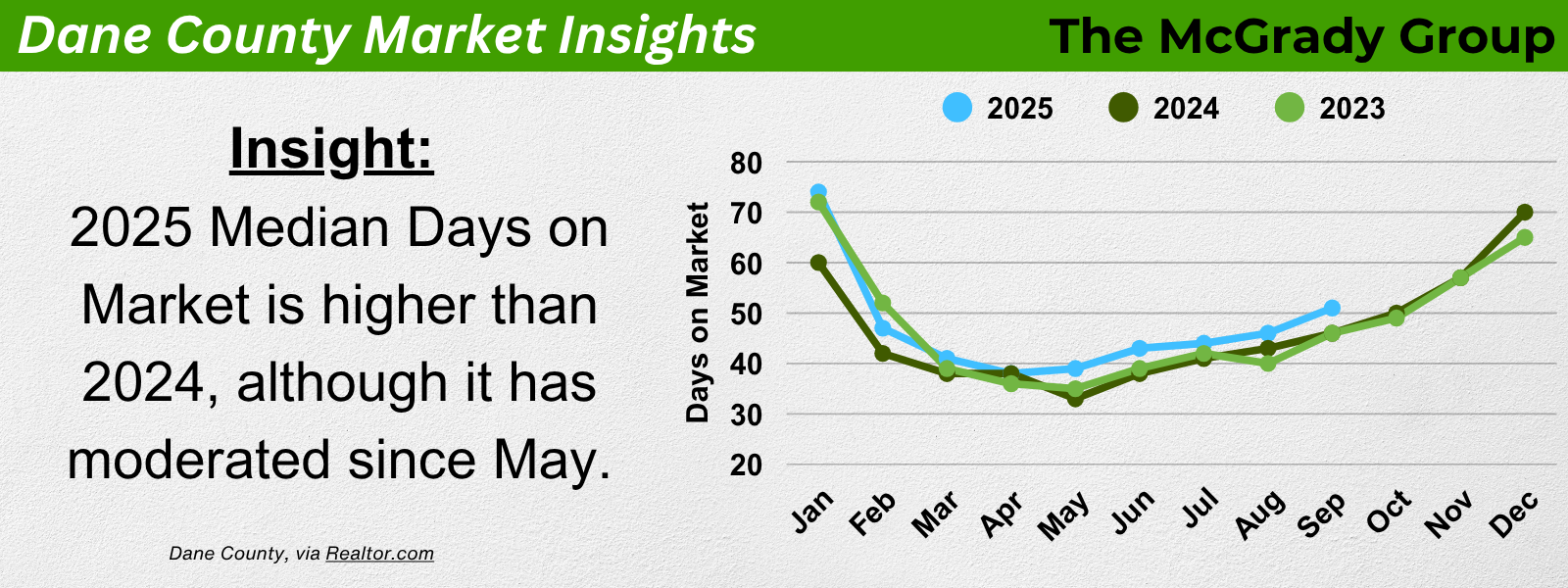

In addition to more inventory for buyers, we see a steady jump in the “Days on Market” number. Historically speaking, a healthy real estate market has a 3-6 month supply of active listings. 90-180 days on the market. This concept is completely lost on today’s Dane County market participants, who are experiencing 1-2 months. Taking 3-6 months to sell a house?! Can you imagine if that were the norm? In our opinion, we are just reverting to the mean, and it will take longer to sell the average home as we wrap up the year.

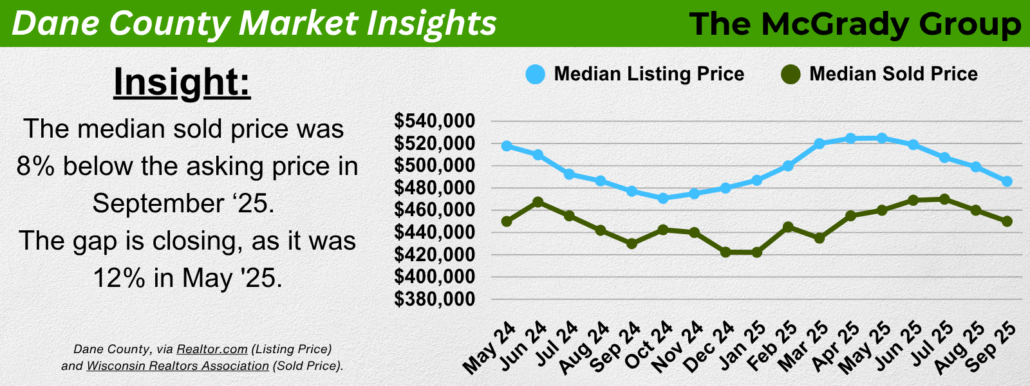

As we enter 2026, another data point we want to pay attention to is price reductions of active listings. If the market softens, you should see a larger gap in price reductions compared to the list price, followed by a noticeable decline in average list prices. This plays out in Q2 and Q3, but it’s hard to say whether list prices are coming down due to market forces or because it’s the end of the year, and historically, most buyers wait until Spring. However, it’s clear that the days of 5-10% annual price growth are coming to an end, unless there is a dramatic shift in interest rates, dropping into the 5-6% range.

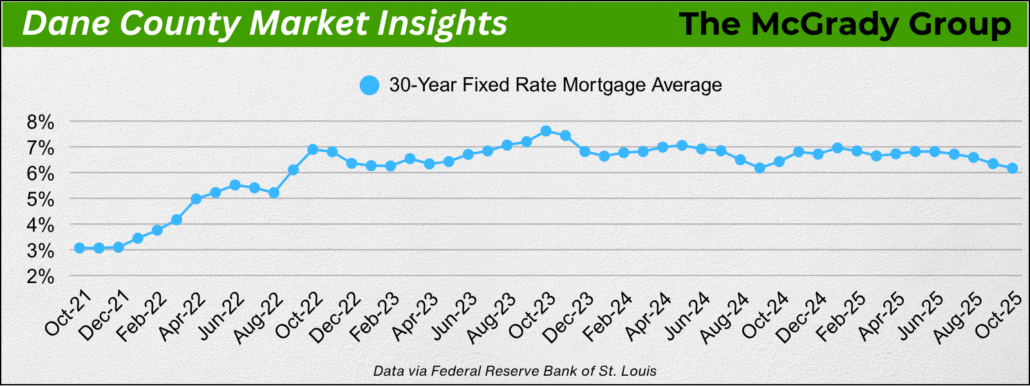

That leaves us with interest rates. It is our strong opinion that our area is handcuffed by Sellers who have a low mortgage interest (2-3%), simply doing the math on whether it makes sense to sell and jump into a much higher mortgage rate on a new home. They stay put when rates are above 6%.

However, as you can see on our interest rate tracker, the trendline is moving towards sub-6% interest rates. Should this happen, we expect a significant surge in listings, with buyers and sellers coming off the sidelines, which should help keep prices flat moving into 2026.

In Summary

We expect the market to simply continue reverting to the mean. This means prices stay flat, it takes longer to sell a home, and buyers are able to make reasonable offers with the added benefits of inspections and appraisals. The days of 10% price jumps in a year are over (for now).

The McGrady Group is ready to help you succeed in a quick-moving market. Contact us now to develop a plan that capitalizes on these market trends.

Warm regards,

Matt & Seth

The McGrady Group