Dane County’s Summer 2025 Market Insights

In our Spring market outlook, we predicted that 2025 would repeat the trend lines of 2024. So far, that prediction has held steady. This update continues our focus on Dane County market data, mortgage rates, and provides insights for buyers and sellers on Summer 2025 Market Real Estate Trends.

Sellers Market Tailwinds

“All Real Estate is Local.” Wise words. Nationally, April sales data shows market weakness in many markets across the country – see this recent NAR analysis. Nationally, pending sales contracts are down 6% YOY. Some markets are seeing many listings sit and pile up on the market, and prices are falling.

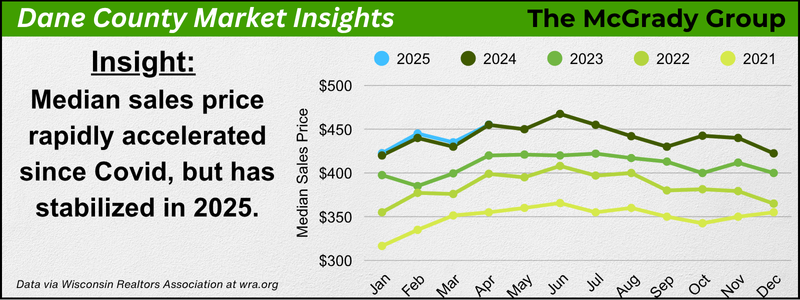

But locally, Dane County prices are holding steady. Remember, prices rose 10% in 2024 (so did property tax assessments). We are simply holding onto big gains. The key for Dane County sellers is the low inventory and quick sales of average-priced homes.

However, one thing to keep an eye on is that our market suddenly lost its third pillar of a seller’s market: Rising prices. Welcome news for buyers, but sellers are still in control.

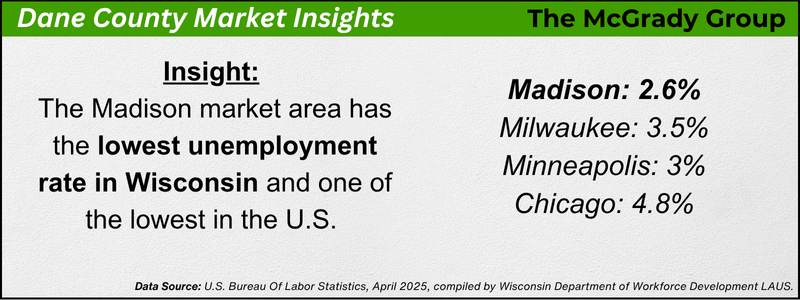

Along with steady prices and low inventory, unemployment for the Madison market area is the lowest in Wisconsin at 2.6%. Local buyers are gainfully employed and continue to prove they have savings and investments, making them well qualified. Other real estate markets are not so lucky.

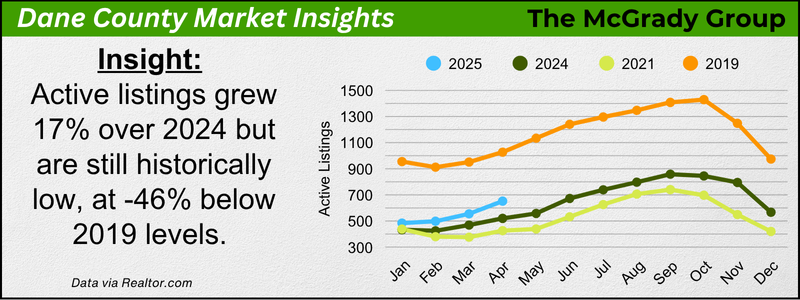

The big story continues to be supply-side shortage as the annual number of homes listed is still 46% below 2019 levels. Will listings increase? So far in 2025, they are up 17%. But prices are holding steady. Therefore, we expect Summer 2025 to repeat in terms of volume and average sale prices to stay flat or continue to tick up. Supply is low, Demand is high. Pretty simple.

Sellers Market Headwinds

All is not rosy, however. Despite the new administration’s best efforts to bully the bond market by pulling levers and throwing wet noodles at the wall to see what sticks, it does appear that 7% interest rates will be persistent.

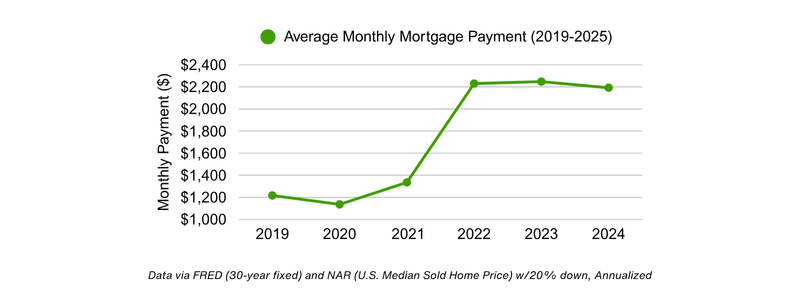

The scariest chart out there is the one below, which shows the rise in the average mortgage payment based on a 20% down/80% LTV mortgage, no PMI, and applying it to the average rise in home prices since 2019.

Basically, anyone who buys a house today pays $12,000 more per year than the neighbor who bought the same house 5 years ago. At some point, Buyers “tap out” and the home sales drop. Nationally, home sales are going to slow down, and it’s already reflected in the 2024 NAR data we linked above. Will this affect Dane County in 2025? So far, no.

In Summary

Despite all the noise over the last 12 months, we are exactly where we were in Spring 2024 with ~7% interest rates. Despite high rates, prices in Dane County still went up 10% in 2024. The question everyone should be asking is how long can home buyers keep this up? Our best guess is prices stay flat or tick higher because of low inventory and a strong buyer pool. Good homes in hot locations will continue to sell fast for top dollar.

The McGrady Group is ready to help you succeed in a quick-moving market. Contact us now to set a plan to capitalize on these market trends.

Warm regards,

Matt & Seth

The McGrady Group